Is your practice losing money due to the complexities of uninsured medical service billing? Many physicians unknowingly miss out on revenue because they don’t fully understand these intricacies. Mastering the nuances of uninsured billing is essential for ensuring fair compensation for your expertise and time.

In this blog, we’ll answer your most common questions about billing for uninsured medical services, such as how to charge for prescription renewals, billing for tests like TB and driver’s medical tests, determining appropriate pricing, identifying which services can be billed directly to patients, and more.

Frequently Asked Questions

Can I charge for prescription renewal requests through fax/phone (without an appointment)?

Yes. Prescription renewal requests sent through fax without an appointment are deemed as an uninsured service by the Ontario Medical Association (OMA). Based on the latest guidelines provided by the OMA, we recommend a $25.00 charge for prescription renewal requests (2024).

If I am a FHO doctor, can I charge for prescription renewals (without an appointment)?

Yes. Prescription renewal requests sent through fax without an appointment are deemed an uninsured service regardless of whether the physician is part of a Payment Enrollment Model (PEM) or not.

When should I charge a patient for a TB test?

As a physician, you can charge a patient for a TB test in the instance that an immunization/TB test is requested solely for employment purposes. The test and the completion of the form is uninsured and can be billed to the patient or a third party.

Please note that the use of the publicly funded Tubersol is not permitted if the test is requested for employment purposes.

How much should I charge for an uninsured TB test?

The OMA recommends charging a minimum fee of $65.00 for TB tests.

In what instances should I not charge for a TB test?

TB tests are considered medically necessary and billable to OHIP in the following instances:

1- If a Ministry of Health program requests an immunization/TB test and completion of form/report, but the appropriate fees can be billed to OHIP: For TB test, this may include A001 or A007 for the visit/assessment and G372 for the injection or G373 if the test is the sole reason for the visit.

2- If an immunization/TB best is requested by a patient for:

- Admission or continuation in a daycare or pre-school program or a school, community college, university, or other educational institution

- A program as evidence of immunization status

- A test is required to satisfy a condition of being admitted to a Long-Term Care (LTC) facility

3- If a physician determines that an immunization/TB test is medically necessary, and the service is received wholly or partly for the production of a document or the transmission of information that relates to any of the circumstances listed below. The immunization form/report is NOT insured and can be charged to patients.

In the above instances, the TB test is covered by OHIP and you cannot charge a patient directly.

When should I be charging for ear washing/syringing as an uninsured medical service?

According to the Schedule of Benefits, ear syringing is only insured by OHIP when:

- There is impacted ear wax resulting in hearing loss that is unresponsive to topical application of cerumenolytics; or

- Immediate removal of ear wax is medically necessary to visualize the tympanic membrane or the external ear canal for diagnostic and/or therapeutic purposes.

All other reasons for ear syringing are considered uninsured and, therefore, can be charged to the patient.

Can I charge for missed appointments/no-shows?

It is acceptable to charge patients for missed appointments or procedures if less than 24 hours’ notice has been given. However, the OMA does not have a standard recommendation for missed appointment fees, as it should be based on the physician’s hourly rate. Typically, physicians with an annual fee program charge $50 for missing a regular appointment and $100 for missing a physical appointment

Once the fees have been set by the physician, the policy should be clearly explained to patients at the time of booking and, if possible, consider having the patient sign a letter of acknowledgement of office policies.

When should I be charging for massage/orthotics/physio/chiro referral notes?

These notes are billable to the patient when they are required for insurance purposes. For example, the patient’s insurance company may ask for a note/referral from their physician stating that services are necessary for them to be covered by the patient’s personal insurance plan.

How should I determine pricing for forms that the OMA states should be based on your hourly rate. For example, how do I determine my hourly rate for an APS request?

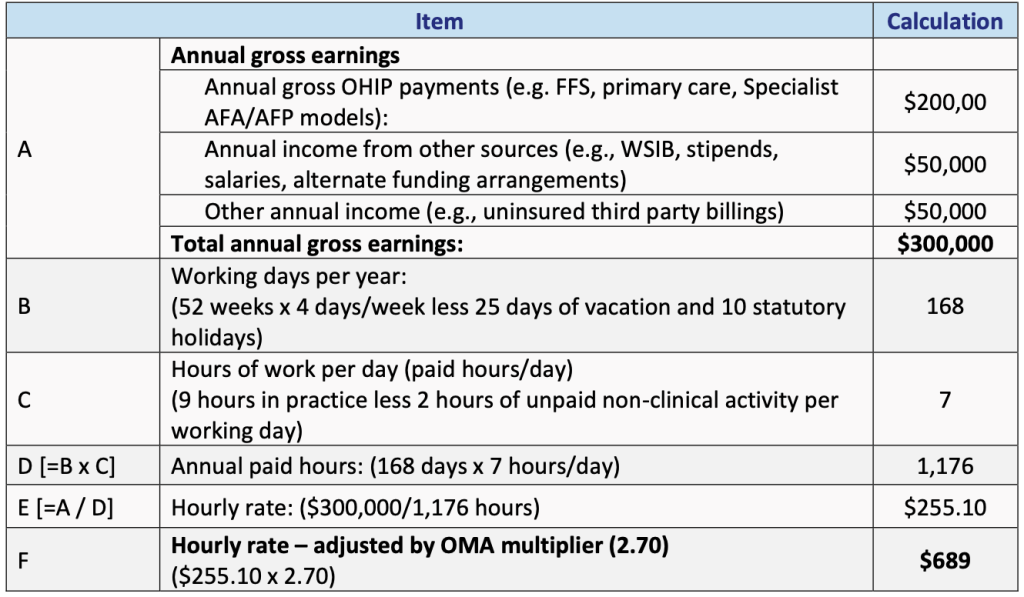

The OMA does not recommend a standard, suggested hourly rate that applies to all physicians. In the latest Physicians Guide to Uninsured Services released in 2024, they include the following calculation example for a physician with $300,000 in gross billings.

Another example of determining an hourly rate is to use an average day’s income divided by the hours worked.

The OMA has created a calculator to help you determine your individual hourly rate, which you can find here: OMA Calculator.

For APS requests specifically, the OMA suggests physicians charge a minimum of $150.

Through our Annual Fee Program, we can help to determine appropriate pricing for forms that the OMA states should be based on your hourly rate.

What is the pricing for a driver’s medical (MOT)? Should I charge for the exam and the form completion?

The 2024 OMA suggested fee for a driver’s medical exam form is $70.00. As for the exam itself, the fee changes depending on the kind of exam is performed. See the table below for full rates:

Forms | Description | 2024 OMA Fee |

– | Driver’s medical examination (form only) | $70.00 |

Assessments: |

|

|

A007 | Intermediate assessment | $102.50 |

A003 | General assessment | $235.85 |

Axxx | Medical specific assessment | Fees vary |

Axxx | Partial assessment | Fees vary |

A233 | Ophthalmology specific assessment | $155.80 |

(Forms) Visual assessments: | ||

A110/A112 | Periodic oculo-visual assessment (by a general/family practitioner) | $132.05 |

A115 | Major eye exam | $138.00 |

A237/A239 | Periodic oculo-visual assessment (by an ophthalmologist) | $152.85 |

G814 | Orthopedic examination | $67.50 |

Other services: | ||

G857/G436 | Visual fields -kinetic (with permanent record) – technical and professional combined | $51.75 |

G858/G432 | Visual fields – static – technical and professional combined | $110.75 |

G010 | Urinalysis- without microscopy | $7.15 |

Should I be billing HST/GST on uninsured services?

Physicians are required to register, collect, and remit HST when their annual HST taxable sales and revenues exceed $30,000.

Physicians are suggested to consult with an accountant prior to registering for HST. They are also encouraged to contact the CRA or their accountant to obtain clarification on individual concerns or refer to the CRA website.

Examples of services subject to HST:

- Cosmetic surgical procedures and all related medical services.

- Medical reports based on chart review.

- Block/annual fees.

- Witness fees for court appearances.

- Medical examinations for which the primary purpose is not motivated by the protection, maintenance, or restoration of health.

Services exempt from HST:

- Consultative, diagnostic treatment to other healthcare services provided by a physician to an individual, including executive medical assessments carried out for the purpose of health care for the patient and prescription renewal without a visit.

What immunizations are considered uninsured? What should I be charging?

Immunizations rendered solely for the purpose of travel (and not for communicable diseases endemic in Canada), as well as pre-departure travel medicine services, are considered uninsured medical services. This includes assessments, counselling, or the administration of vaccines or drugs for the prevention of communicable diseases not endemic to Canada.

In addition, the cost of the drugs/vaccine in these cases is directly billable to the patient.

Do you have more questions or need support with your uninsured medical services billing? We’re happy to help!

Our expert team at Doctors Services Group offers a comprehensive solution to take uninsured medical billing off your plate, from education and invoicing to patient reminders and block fee setup.

By taking advantage of our comprehensive payment collection solutions, you can streamline your processes and focus on what matters most – providing excellent patient care.

Interested in learning more about our services? Contact us today at info@doctorsservices.ca.